Contents

Market order is a commitment to the brokerage company to buy or sell a security at the current price. Execution of this order results in opening of a trade position. Stop Loss and Take Profit orders can be attached to a market order. Execution mode of market orders depends on security traded.

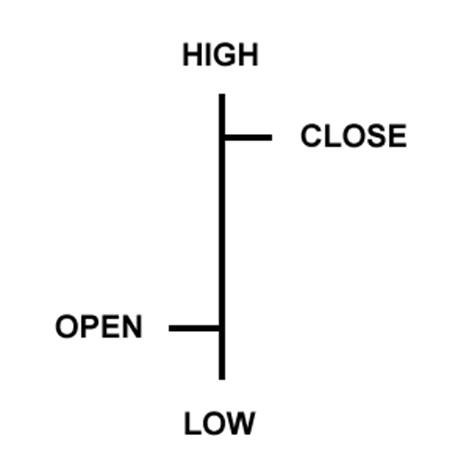

If the security price reaches this level, the position will be closed automatically. Such orders are always connected to an open position or a pending order. The brokerage company can place them only together with a market or a pending order. Terminal checks long positions with BID price for meeting of this order provisions , and it does with ASK price for short positions . His simple market analysis requires nothing more than an ordinary candlestick chart. A relatively simple trading strategy, one that has just a few trading rules and requires consideration of a minimum of indicators, tends to work more effectively in producing successful trades.

Two Tips to Avoid Getting Stopped Out

And I use profit targets or a trailing stop loss to exit winning trades. An ATR trailing stop loss indicator could be used to aid in this. Here is an example of one on TradingView called ATR Stops set to a 1 ATR multiplier (and 7-period ATR) on the EURUSD daily chart. In the forex market, most retail brokers only offermarket orderstop losses.

You should always set your stop according to the market environment or your system rules, NOT how much you want to lose. A trader is putting a stop, which is in accordance with his trading plan. If you make pips, you got to be able to keep those profitable forex scalping strategy pdf pips and not give them back to the market. In human words, it’s saying „sell this thing if you see that anyone traded with it at $180, but don’t sell it lower than $160”. For a tailored recommendation, check out our broker finder tool.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. A spread is a cost built into the buying and the selling price of all the currency pairs. How to Calculate Forex Position SizingEach trader in the forex market defines their position size before moving forward with a trade. A stop loss order is used to prevent extensive losses, especially during severe market dip situations. By placing a stop loss order, you can automatically close your position if the market moves against you. Theoretical research on the 1987 stock market crash suggests that such trading can cause price discontinuities, which would manifest themselves as price cascades.

If you want to find amazing trading opportunities that most traders overlook, learn our options trading stop-loss strategy. In this step-by-step guide, you’ll learn how to build a trading risk management strategy. A stop order is an effective tool that should be part of any risk management trading strategy. Another thing that can happen is that the trade barely survives. After hours and hours of waiting, the trader decides to exit the position, only to see the currency move impulsively in the right direction. All traders have encountered this feeling, and it is a rough experience.

But the risk to the broker is that you might screen-capture your charts. Because from a risk to reward perspective, it doesn’t make sense. “It triggers my stops and then reverses back in my original direction, putting me out of the trade.” Okay.

When you trade with a stop-loss order it will bring more composure, rationality, and peace of mind. This, in turn, will eventually lead to bad trading behavior and taking unnecessary losses. You also need to ask yourself the following questions when considering when implementing a trailing stop stop-loss.

Placing Stop Loss Orders Quickly While Day Trading

Now traders follow the economic events with new vision as inflation in the US seems like decreasing. Let’s see what releases will influence the market due to that factor. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing.

Unfortunately, there is no sure way of stopping this from happening. The only thing you can do is to avoid trading during the off-peak trading times, or times before an economic announcement. These are all times of low liquidity and it’s easier for the financial institutions to influence market prices then. For stop-loss hunting to occur, the financial institutions will need to buy a large volume of currency before prices can move in the direction that the institutional traders want them to. The size of this stop depends on the size of volatility at the market.

Trailing Stop in MT4

Both stop loss and take profit options are tools that can be used on the trading software you will be using with your brokerage. But if it doesn’t you may check with your service provider since the tool is very important. It tells your broker how much you are willing to make as a profit with one trade and close it once you’re happy with the amount. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Although where an investor puts stop and limit orders is not regulated, investors should ensure that they are not too strict with their price limitations. If the price of the orders is too tight, they will be constantly filled due to market volatility. Stop orders should be placed at levels that allow for the price to rebound in a profitable direction while still providing protection from accentforex review excessive loss. Conversely, limit or take-profit orders should not be placed so far from the current trading price that it represents an unrealistic move in the price of the currency pair. The size of this stop depends on the technical analysis of the price action conducted by a trader. Here one usually identifies support level and puts Stop Loss order for a long position below it.

- Orders of this type are usually placed in anticipation of that the security price, having reached a certain level, will keep on falling.

- The moment the exchange rate reaches the set amount, the trade will be closed, and the trader will be able to walk away with his or her profits.

- A common argument against stop losses is that it means you a prematurely taken out of a trade.

- Place a stop-sell order a few pips below the support level so that when the price reaches your specified price or goes below it, yourshort positionwill be opened.

- Therefore, I’ll also provide a couple of entry ideas as well.

- When the price on your position increases, it drags the trailing stop along with it.

Limit orders are used to set your profit objective.Before placing your trade, you should already have an idea of where you want to take profits should the trade go your way. A limit order allows you to exit the market at your pre-set profit objective. Limit orders are commonly used to enter 12trader review: online forex broker a market when youfadebreakouts. You fade a breakout when you don’t expect the currency price to break successfully past a resistance or a support level. In other words, you expect that the currency price will bounce off the resistance to go lower or bounce off the support to go higher.

Had your order not been there, the price would have done the same thing. It happens to the best traders often 50% or more of the time…and yet the good traders still make good money even with placing stop losses and having them get hit often. Stop and limit orders are therefore crucial strategies for forex traders to limit margin calls and take profits automatically. An investor with a long position can set a limit order at a price above the current market price to take profit and a stop order below the current market price to attempt to cap the loss on the position. An investor with a short position will set a limit price below the current price as the initial target and also use a stop order above the current price to manage risk. The high amounts of leverage commonly found in the forex market can offer investors the potential to make big gains, but also to suffer large losses.

It locks in profits and helps you to manage the risk if you add to your open position. I use stop losses so losses are controlled, and I simply close losing trades. In between trading stocks and forex he consults for a number of prominent financial websites and enjoys an active lifestyle. Simply put, a stop loss should be placed where a strategy dictates. See the Double Pump day trading forex strategy as an example.

What are take profits?

When you open a position, you can set the minimum price increase whereby if the asset price reaches that point, the position will automatically close to secure the generated profits immediately. The position of a Stop Loss may depend on whether you are a discretionary or a system trader. In discretionary trading, it’s the trader himself/herself who every time decides which trades to make. A trader places Stop order at a price at which he/she doesn’t expect the market to trade. By doing so, he/she may take into consideration different factors, which may differ from trade to trade.

In case you are wondering is Forex trading profitable, the short answer is yes. But many opt for Forex traders to make fast profits since Forex markets are operational 24 hours for five days a week. What is Leverage in ForexLeverage allows traders to hold large positions in the Forex market with fewer capital. With leverage trading, traders can borrow money from a broker and hold larger positions, which in turn could magnify returns or losses. From your entry to your initial stoploss is your risk in pips. Your position size determines the dollar value of those pips, and of your risk.

In forex trading, avoiding large losses is more important than making large profits. That may not sound quite right to you if you’re a novice in the market, but it is nonetheless true. Winning forex trading involves knowing how to preserve your capital. To succeed with options trading, look at trading the same way as professional traders. Through this stop loss technique, you can better control the risk and protect from volatile markets, ranging markets and fundamental shifts in the supply and demand equation. If a stock, for example, costs $100, a trader might issue a stop-loss order at $90.

You can type in the price you want your stop loss to be placed at. A common argument against stop losses is that it means you a prematurely taken out of a trade. New traders will recite an experience of seeing a price drop 2 pips past their stop loss and reversing back to whether they would have taken profits. Clearly this is a frustrating experience – but there are three better answers to not using a stop loss. A guaranteed stop loss is a type of stop loss order where a trader will arrange with their broker, often for a fee, to guarantee the stop loss will be triggered at the pre-agreed price.